There are a number of reasons to get organized—especially during these turbulent economic times. Let’s face it—the world is chaotic right now and frankly, there’s not much we can do about it. But we can control our homes, that one little corner of the world that is just our very own. Turning your home into an organized haven of calm is more appealing now than ever, because being organized gives you peace of mind and a sense of control.

If those touchy-feely reasons aren’t compelling enough, here’s one more to add to your list: cold, hard cash. The more organized you are, the less money you spend on late fees and wasteful spending on items you already have but can’t get your hands on when you need them. Now more than ever it pays to be organized.

“OK,” You say, “I’m ready!”

Which is followed by a contemplative pause…

“But where do I begin?”

This question—where should I begin—is one of the most common I hear when talking to people who want their homes and lives to be more organized. I have written about it before, but now more than ever I realize that people want what an organized home and life bring—less stress, less late fees, more peace of mind, and a greater sense of control, not to mention how great an organized home looks. So here’s my official answer: there is no single right place to begin—the important thing is just to do something. Start somewhere. Start anywhere. Just start.

OK…if you haven’t jumped up from your computer and started organizing yet… I guess you’re looking for something more concrete. And I aim to please. So, let’s start here—let’s start by setting up a bill paying system in your home. This will give you a sense of control when you can always find your bills and know when they’re due, plus you’ll save money by preventing skyrocketing late fees. Sound like a plan? Great. Let’s go!

Step 1: Designate a single, specific spot for the bills.

Your designated spot can be a basket on your kitchen counter or an in-box in your office. The ideal spot is the place where your bills are most consistently landing. The difference is now you’ll add a container—a basket, file folder, or in-box—just for the bills. Nothing else can go in this particular container and you habitually put your bills here and only here.

Step 2: Pull your bills out of the mail every day.

When you go through the mail, separate your bills from the rest of the mail and put them in their designated spot. Bills are the most important items in your mail because if they aren’t handled in a timely manner, they cost you money. So, you don’t have to go through and read all your mail every single day. Instead, start by pulling out the bills and putting them where they go.

Step 3: Decide on a bill paying schedule.

There are a number of ways to approach this decision. You could select specific days of the month to pay the bills based on your paycheck schedule. For example, if you get paid every other Friday, you could choose to pay your bills on the following Monday. Or, you could choose to pay bills every single Thursday. The important thing is to decide on your schedule, and then, set up reminders until you get into the habit of paying your bills on this new time schedule.

Step 4: Make it easy to *remember* to pay your bills.

For this, you need to know yourself and what works for you. If you’re good about using your calendar to manage your tasks for the day, (and you look at your calendar consistently) add your bill paying dates to your calendar.

If you don’t use your calendar consistently, think about the habits or routines you already have established. For example, if you use a note pad to create new to-do list every day, start a week’s worth of to-do lists in your pad and add “pay bills” to Thursday (or whatever day you’ve decided as your bill paying day.) When Thursday rolls around, pay your bills, and then, make your next seven to-do lists, adding “pay bills” to next Thursday’s list.

If you prefer visual reminders, make yourself a big note that says “Is it Thursday? If so, pay your bills!” and put this somewhere that you will see it often, maybe right above your bill paying basket!

Step 5: Make it easy to *pay* your bills.

All of the above steps can be skipped if you set up online banking with automatic bill pay. With this, you schedule to pay your bills as soon they come due and everything happens on autopilot. However, if you prefer a manual bill paying method, so you can track where your money is going, or if you prefer to pay bills with checks, you can still make life easier on yourself. Create a bill paying mini zone, by collecting your bill paying supplies together in a designated spot or container. If they’ll fit in your bills to be paid container, even better! Then, when it comes time to pay the bills, grab your bill paying supplies and your bills. Paying bills will be a breeze.

Step 6: Make it fun.

Step 6: Make it fun.

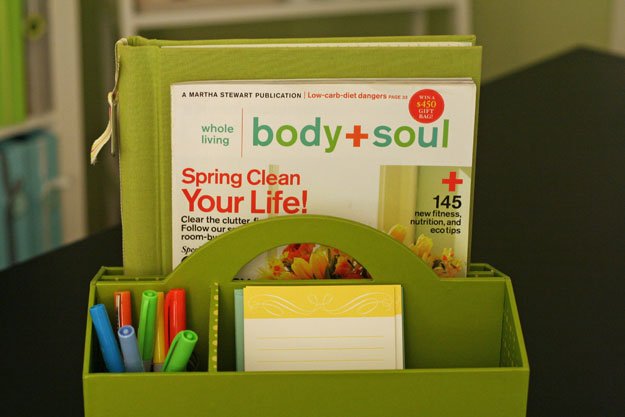

…or at least as fun as possible. Select a bill paying basket you love. Get colorful file folders for your bills to be paid. Next time you get checks, splurge on your favorite design. Designate your favorite pen as your bill paying pen. Simple pleasures go a long way to making an unpleasant task just a notch more enjoyable.

If you’d like more help organizing your paperwork, be sure to check out my self-paced online class Organize Your Paper Clutter. You’ll get a step-by-step process for organizing all the paper in your home, making it simple to get organized. And the self-paced format means you can start today and make progress on your time schedule. Learn more about Organize Your Paper Clutter.

I’m so terrible with paying my bills on time